The smart Trick of Swap Definition & How to Calculate Gains - Investopedia That Nobody is Discussing

Interest Rate Swap - Learn How Interest Rate Swaps Work

7 Simple Techniques For Swap Definition & Meaning - Dictionary.com

Overall Return Swaps In a overall return swap, the total return from an asset is exchanged for a fixed rate of interest. This offers the party paying the fixed-rate direct exposure to the underlying asseta stock or an index. For example, a financier could pay a set rate to one party in return for the capital gratitude plus dividend payments of a swimming pool of stocks.

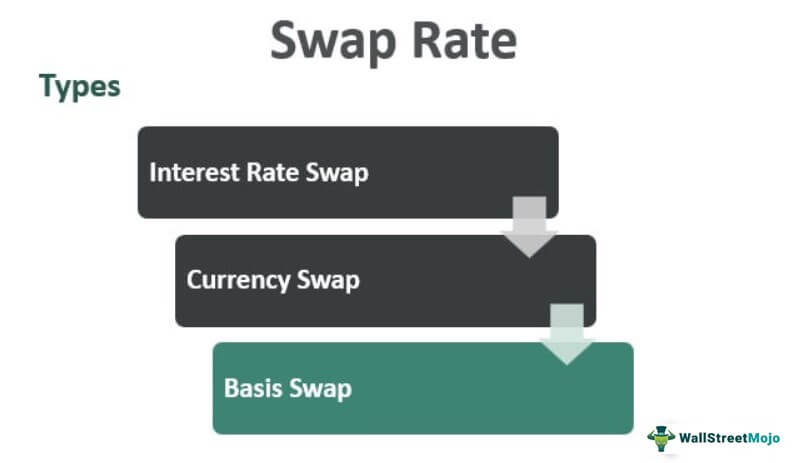

Extreme take advantage of and bad risk management in the CDS market were contributing reasons for the 2008 financial crisis. Swaps Summary A monetary swap is an acquired agreement where one party exchanges or "swaps" the cash flows or value of one property for another. For instance, a business paying a variable interest rate might switch its interest payments with another business that will then pay the first business a set rate.

Exchange of derivatives or other monetary instruments In finance, a swap is an agreement between two counterparties to exchange monetary instruments or cashflows or payments for a specific time. The instruments can be almost anything however a lot of swaps include money based upon a notional principal quantity. The general swap can likewise be seen as a series of forward agreements through which two celebrations exchange monetary instruments, leading to a typical series of exchange dates and 2 streams of instruments, the legs of the swap.

Color Swap - Online Game - Play for Free - Keygames.com

Some Ideas on SWAP imager - PROBA2 Science Center You Need To Know

This principal normally does not change hands during or at the end of the swap; this is contrary to a future, a forward or an choice. In practice one leg is usually fixed while the other is variable, that is figured out by an unpredictable variable such as a benchmark rate of interest, a foreign exchange rate, an index price, or a commodity cost.

Retail investors do not usually take part in swaps. Example [edit] A mortgage holder is paying a drifting rates of interest on their home loan but expects this rate to go up in the future. Another home loan holder is paying a fixed rate but expects rates to fall in the future. Read More Here get in a fixed-for-floating swap contract.